Wait! Did I hear you say that I can deduct the solar powered system I install on my second home…and that home can roll, float, or be stationary? Yep, you heard that right! Motorhomes, buses, vans, trailers, 5th wheels, boats, and cabins all count as both first and second homes. If you are considering taking the solar plunge and want to save money through both federal and state tax incentives, now is the time. To help you get started, we’ve researched answers to the most common questions and have provided links to the resources you need.

As defined by the IRS, a home includes a “house, houseboat, mobile home, apartment cooperative, condominium, or manufactured home.” It doesn’t matter whether you hire a professional installer or do it yourself. The credit not only applies to your primary residence, but also a vacation or secondary home. The only exception to this is if you rent out that second home as a business. In this case, you won’t be able to claim the residential credit; instead you can apply for the commercial version — the Solar Investment Tax Credit (ITC), via the US Department of Energy, Office of Energy Efficiency and Renewable Energy (Solar Energy Technologies Office).

How Do the Deductions Work?

The federal incentive is pretty straight forward; a percentage of the overall cost of your installation can be claimed on your tax return…read on for more details and deadlines. State incentives are a little more varied and complex, for example Massachusetts offers a solar loan reduction plan based upon income, while North Carolina allows any solar investment on your home to be excluded from the property tax value. To learn about your state’s programs, visit the

Database of State Incentives for Renewables & Efficiency. And if you need help navigating the complexity of your state’s programs, finding a local installer might help cut through the confusion and red tape.

What Type of System Qualifies?

Any solar powered system (of any size) installed and operational before January, 1, 2024 will qualify. Both off grid and on grid systems are included in the program, as well as any shared systems of which you might be a partial owner of. This is referred to as “Community Solar” and is detailed here at the National Community Solar Partnership site.

How Much Can I Deduct on my Federal Return?

The deductible percentage of your installation started out at a whopping 30% in 2019, and has been reduced to 26% for equipment installed between 2020-2022. It will be further reduced to 22% for any installation completed by December 31, 2023. So, it makes both cents and sense to act soon! For a $12,000 system installed this year, your federal tax credit will be $3,120, but only $2,640 in 2023. If your solar credit ends up being more than your total tax owed on your 2021 return, you can carry the remainder over to the 2022 tax year. It is unclear, at this point, if this benefit will be allowed to carry beyond 2023. Click here for further details and updates regarding these federal tax incentives.

What Costs Can I Include?

You can include all materials, products, and labor for installing your solar system — anything related to

panels, charge controllers, deep cycle batteries, inverters, wiring, brackets, accessories, and more can be included in the total investment cost. This includes both panels that you install directly on the roof, or solar roofing tiles which perform double duty as energy producers and roofing surface. It does not, however, include any improvements that you might need to make to the roof of your house, support reinforcements, etc., which allows your roof to handle the extra weight of the panels. If you reinforce your roof, it’s still just a roof and cannot be included in the tax credit.

To claim the credit for residential systems, you must file IRS Form 5695 to report your expenses.

To claim the credit for

commercial systems, you must file IRS Form 3468 to report your expenses.

Note: The above links are for 2020 IRS forms, so just be sure to use the appropriate form for the year(s) you plan to claim this credit.

What Records Do I Need to Keep?

All you need to retain for your records are any receipts for solar equipment and installation fees. You do not need to submit these receipts with your return, but simply save them along with your tax documentation.

Can I Get Assistance with Financing? If you want to become power independent now and pay later with very low interest, Renogy can help with financing! Or, you can simply use a Home Equity Line of Credit through your bank if you own your home.

As educators, it is our goal to try and make complex ideas simple and accessible so that people can get their heads around them. We believe knowledge is power…and in this case, it’s sun power. We also love to answer questions, so feel free to contact us through our website.

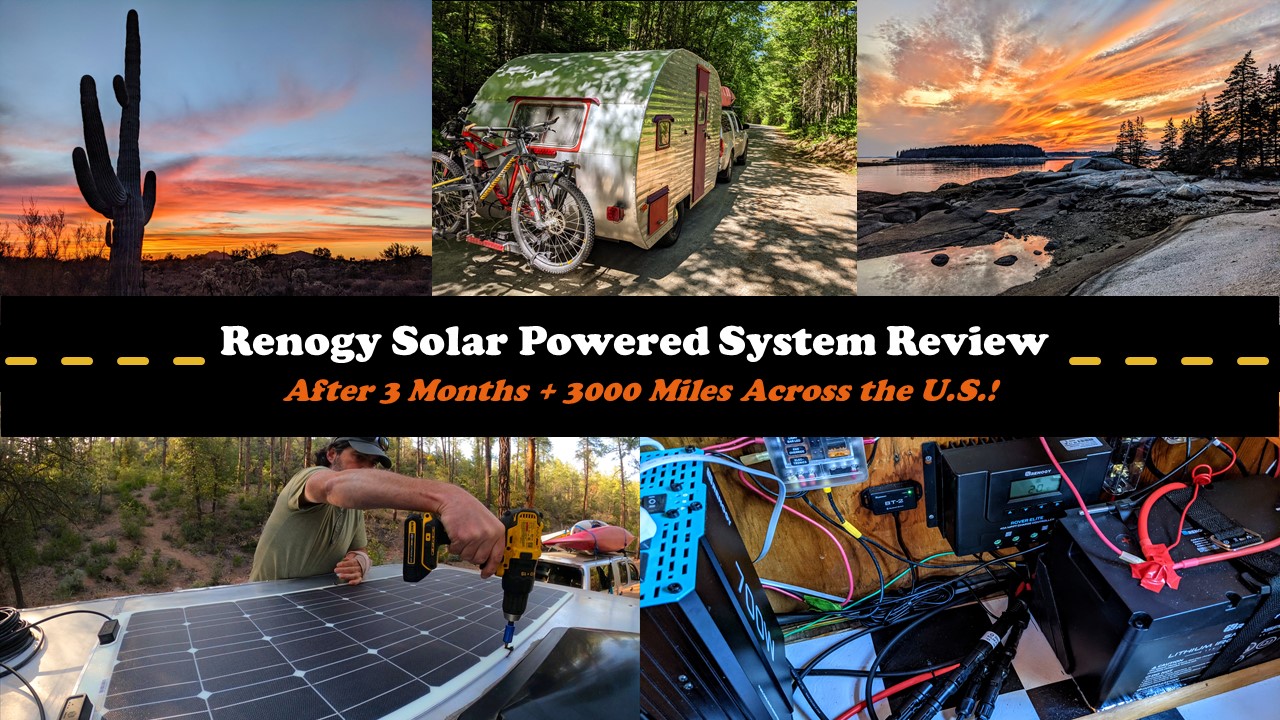

Over the past

9 years of living with mobile solar, we’ve gotten a ton of questions about our solar powered system. If physics or math scares you, don’t worry…solar is user friendly and very accessible once you grasp a few key fundamentals. Of course you can leave the technical stuff to the engineers and installers, but it’s a good idea to learn some essential lingo before you dive into purchasing a system. Our Solar 101 videowill help you calculate your total watt hours and assist you with making some decisions about the panels, charge controller, batteries, and inverter you will need to create an off-grid system that meets your energy needs.

In 2012, Shari Galiardi & David Hutchison left behind their careers and a comfortable home in North Carolina, to travel with the vintage camper trailer they lovingly restored, outfitted with solar, and named “Hamlet.” What began as a short break from their careers and responsibility quickly turned into a love affair with roadlife. They have parlayed their higher education backgrounds, desire for life-long learning, and thirst for adventure travel into writing, photography, video production, and public speaking gigs from coast to coast. Known to their friends as simply Shari & Hutch, you can learn more about their full-time, solar-powered adventures on their website at

freedominacan.com. Or, you can follow them on Facebook, Instagram, and YouTube as “Freedom in a Can, LLC.”